**Google Finance Introduces Deep Research AI and Prediction Market Data Integration**

Google is bringing significant upgrades to its Google Finance platform, aiming to provide users with deeper insights and more powerful forecasting tools by leveraging artificial intelligence and crowd-sourced prediction data. These new features, building on Google's recent push to infuse AI across its products, promise to transform the way investors and casual users analyze financial information and anticipate future trends.

**Expanded AI Capabilities with Gemini Deep Research**

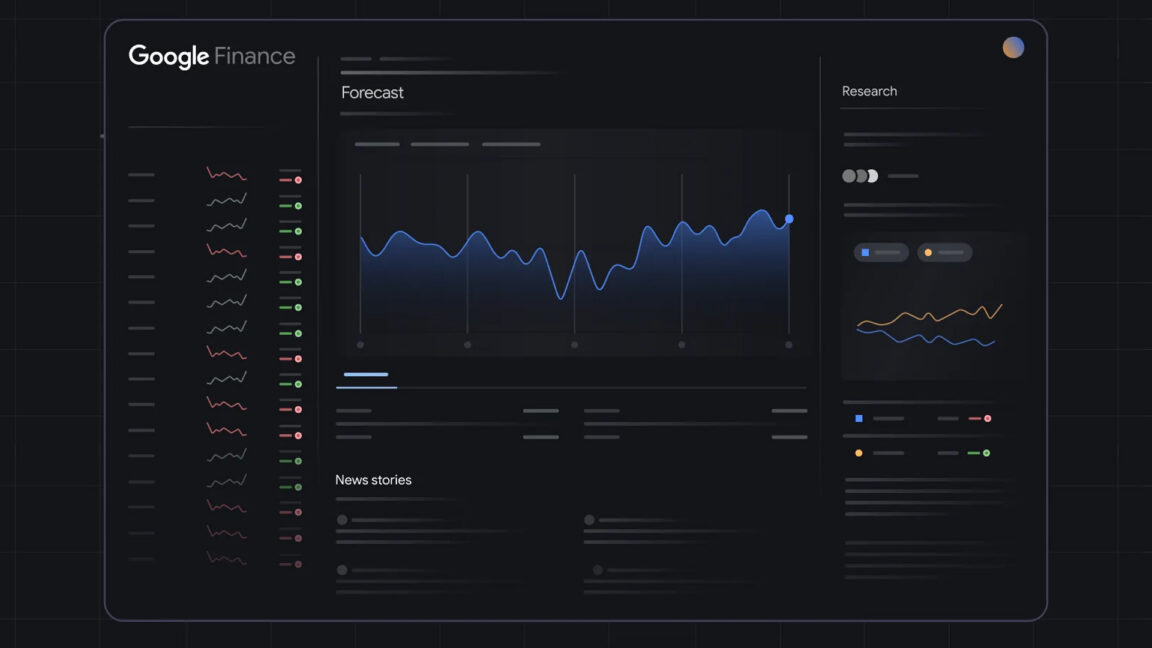

At the heart of the update is the introduction of Gemini Deep Research, an advanced AI-powered tool that enables users to conduct in-depth research on complex financial topics. This feature builds on the previous addition of a Gemini-based chatbot to Google Finance, which allowed users to ask basic questions and receive AI-generated answers. With Deep Research, Google is taking things several steps further by allowing for more sophisticated, multi-layered queries.

Rather than simply responding to straightforward questions like “What is Apple’s current stock price?”, Deep Research is designed to tackle more challenging inquiries that require synthesis of large amounts of data and multiple sources. For example, users could ask, “How has renewable energy investment impacted tech sector performance over the last decade?” or “What are the potential economic impacts of upcoming regulatory changes in the banking industry?” The AI will then generate detailed, fully-cited research reports, drawing from a wide array of reputable sources. According to Google, these reports can be produced within minutes, providing timely and relevant analysis for users.

However, there are some limits on usage. While all users will be able to run a few Deep Research reports, the exact number is not specified and may depend on subscription level. Google offers AI Pro and AI Ultra tiers, which come with higher limits—potentially up to 20 and 200 reports per day, respectively, based on similar offerings in the Gemini app. Given the time and computational effort required for each report, most users will likely find the limits sufficient for their research needs.

**Prediction Market Data: Harnessing the Wisdom of Crowds**

In addition to AI-driven research, Google Finance is integrating prediction market data from two leading platforms: Kalshi and Polymarket. Prediction markets are online platforms where participants can place bets on the outcomes of real-world events, ranging from political elections to economic indicators and even company-specific news. The idea is that when people have a financial stake in the outcome, their collective forecasts can be surprisingly accurate—a phenomenon often referred to as “the wisdom of crowds.”

By partnering with Kalshi and Polymarket, Google Finance will be able to pull in real-time data on how thousands of individuals are betting on future events. For instance, if a user wants to know, “What will U.S. GDP growth be in 2025?” the platform can now supplement AI-generated analysis with up-to-date probabilities and predictions based on crowd sentiment from these markets. The resulting reports may include not only text-based insights but also visual elements like charts and graphs that reflect the current betting odds and